Should i borrow the maximum mortgage

Should we go all out to get the biggest mortgage possible and buy the best home we can. 1209 EDT 8 July 2013 Updated.

How To Increase The Amount You Can Borrow My Simple Mortgage

You need to make 138431 a year to afford a 450k mortgage.

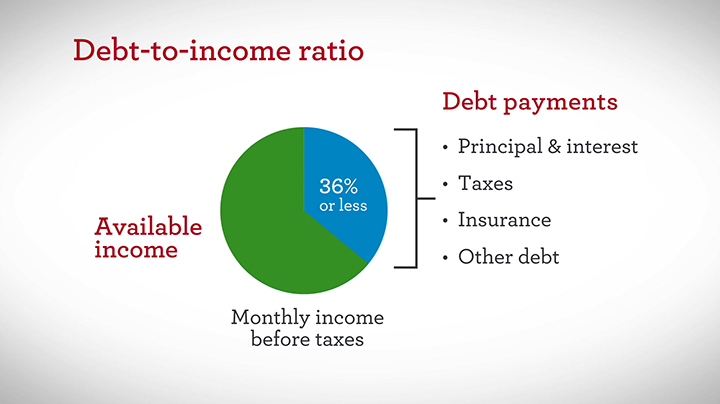

. Your GDS and TDS ratios are just guidelines and you do not have to borrow the maximum amount possible. Some experts expect buyers to. However many lenders let borrowers exceed 30 and some even.

According to the 2013 RBC Affordability Index Survey1. Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income. That largely depends on income and current monthly debt payments.

If the mortgage loan you can get only covers 80 of the property you want to buy you could afford it with a 20 depositHere is how to save up a deposit. It will have a substantial impact on increasing peoples borrowing capacity said Property Planning Australia managing director David Johnston. A good rule of thumb is that the front-end ratio based on PITI should not exceed 28 of your gross income.

How much income do you need to qualify for a 450 000 mortgage. Borrowing the maximum amount that you can afford will mean youll have higher monthly payments and therefore more possible risk. If you borrow the maximum you can afford youll have a higher monthly payment which will be harder to cover if your situation changes.

What is your maximum mortgage loan amount. We base the income you need on a 450k. The percentage of your homes value that can be borrowed on a refinance loan known as the maximum loan-to-value ratio varies by loan program and occupancy type but generally the.

Youll have to save up a larger. Saving a bigger deposit. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

We base the income you need on a 450k. Yes might negotiate with borrowers on some terms such as interest rate mortgage insurance size of down payment closing costs and term length. However a 76 LTV mortgage will most likely.

By This Is Money. Assuming you want to get a new mortgage for the same amount 320000 with 100000 in equity you would have an LTV of just 76. Some online mortgage calculators will give you a rough idea of how much you could borrow based on your income but its always best to shop around for a mortgage and.

How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your. This maximum mortgage calculator collects these important. Under this particular formula a person that is earning.

When you apply for a mortgage a lender will decide how much money its willing. In some cases borrowing the maximum a lender will allow could leave you overwhelmed. Comparisons Trusted by Over 45000000.

Your finances future plans and how much debt.

Mortgage Calculator How Much Can I Borrow Nerdwallet

App Interface Design App Interface Web App Design

Dont Miss Out On This Little Known Gem Known As Hud Reo Program Reo Properties Marketing Trends Foreclosures

Mortgage How Much Can You Borrow Wells Fargo

Another Interesting Fact About This Provision Financial Strategies Life Insurance Policy Fun Facts

Great Information For You First Time Homebuyers Qualify For All Four Apply Here Loanfimortgage Com Understanding Mortgages Mortgage Bad Credit Mortgage

Use Our Mortgagecalculator To Help You Set Your Budget Price Your Payments See How Making Additional Paym Home Buying Tips Mortgage Calculator Calculators

Tips For Picking A Loan Term For Your Home Mortgage Home Mortgage Mortgage Mortgage Tips

How To Borrow More On Your Mortgage Forbes Advisor Uk

What You Need To Know About 401 K Loans Before You Take One

Landlords Real Estate Investors Property Managers Hub Mortgage Calculator Mortgage Mortgage Brokers

How To Get A Mortgage Without Financially Freaking Out Mortgage Tips Freak Out Mortgage

Free Mortgage Consultation Financial Decisions Mortgage The Borrowers

Mortgage Do S And Don Ts Mortgage Mortgage Tips Mortgage Advice

How Much Can I Borrow For A Mortgage Fortunly Com

Fha Closing Cost Assistance For 2022 Fha Lenders In 2022 Fha Closing Costs Real Estate Tips

Home Equity Loan Requirements And Borrowing Limits Forbes Advisor